Top Construction Accountants & Contractor Accounting Firm

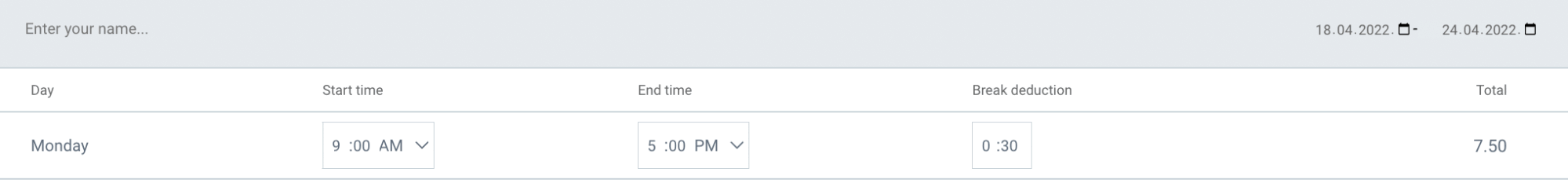

Invensis offers a range of specialized construction industry accounting & auditing services, including financial statement audits, compliance audits, and internal control assessments. Our bookkeeping services for construction companies teams ensure adherence to industry standards and regulatory requirements while providing insights into financial performance and risk management. We also conduct audits of Work-in-Progress (WIP) and project cost accounting, helping construction companies identify discrepancies and enhance financial transparency for stakeholders. The components of accounting software for contractors typically include expense tracking, invoicing, payroll management, and financial reporting. These features allow users to monitor project costs, generate invoices, process payroll, and produce detailed financial statements, all within a single platform. I chose Jonas Construction Software because it integrates accounting features directly into the platform, making it easy for you to manage job costs and track project expenses.

Navigating the Challenges of the Construction Industry

- Take a look at the customer support offerings when browsing construction accounting software.

- We have over 24 years of experience in delivering accounting services for construction companies worldwide.

- Juggling complex contracts, fluctuating material costs, and intricate payroll tasks can quickly overwhelm even the most seasoned construction professionals.

- Your construction firm keeps all kinds of different materials on hand to take projects from start to finish over months or years.

This integration helps maintain consistency and accuracy across all project-related financial data. FreshBooks is cloud-based accounting software for freelancers, small businesses, and contractors. It handles invoicing, expense tracking, and project management, helping you manage your finances. The Bookkeeper offers tailored financial management solutions, allowing construction businesses to maintain precise financial records and optimize their project performance. That’s why so many in the industry are now on the lookout for the best accounting software for construction. When used properly, it can streamline your day-to-day financial processes, help you manage project costs more efficiently, and improve your efficiency across the board.

Streamline Your Financials With Outsourced Construction Accounting

We seamlessly adapt to your preferred software, giving you the strategic advantage, the nimbleness you need and the reliability you can count on. With construction accounting from DB&B, you get more insights with a faster turnaround than in-house accounting without the construction bookkeeping cost of an employee. At an early stage in your company’s growth journey, you might start with simple bookkeeping services. As you grow and encounter new financial challenges, you’ll add more strategic CFO-level services . There’s no question that the construction business is a difficult industry to operate in. From the big picture issues of long-term projects to accounting for every single nut and bolt your company buys, it’s a complex business full of complex challenges.

Top 5 Construction Accounting Software

Proper expense categorization is crucial for accurate job costing and financial reporting. Develop a clear https://blackstarnews.com/detailed-guide-for-the-importance-of-construction-bookkeeping-for-streamlining-business-operations/ system for categorizing expenses and train your team to use it consistently. Their services help improve margins, manage finances by project or customer, and enhance decision-making through detailed financial reports and personalized support. You naturally plan to grow your business with time, so why not plan for your accounting solution to do the same? Some construction accounting solutions offer limited scalability, meaning you’ll be forced to make do or make the switch eventually.

Small Business Resources

Foundation strives to serve construction companies of all sizes, ranging from small businesses to large enterprises. They also offer several integrations to help simplify the day-to-day responsibilities of running a construction business. Construction accounting services are the cornerstone of a thriving construction business, focused on specific needs like job costing, compliance with tax laws, and strategic financial planning. We explore how our essential services can help your construction company optimize costs, adhere to regulations, and ultimately, enhance profitability. No jargon, just clear insights into the vital role accounting plays in your project’s success.

How can a construction firm best go about bookkeeping?

- Implementing construction accounting software can transform your business operations in several ways.

- Features include automated bookkeeping, invoicing, expense tracking, and tax preparation.

- FUTA taxes are reported annually using Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return.

- It’s ideal for contractors who need detailed financial oversight throughout their projects.

- We’re putting ourselves first because we’re passionate about helping construction businesses scale efficiently!

Dedicated construction professionals bring unmatched expertise to our accounting team, tailoring services to the unique requirements of the construction industry. This involves combining technical accounting expertise with a deep understanding of our client’s business, enabling customized service delivery. When you have accurate financial information that you really understand, you have the tools and confidence you need to unlock the true potential and profitability of your construction business. Grow your contracting business with our comprehensive services, including job costing, payroll, and CFO-level support. All our picks for the best accounting software for contractors offer free trials of at least 14 days. Sign up for these trials to test your potential platforms for yourself before committing.